Many business owners get confused between a cash receipt and a sales receipt. Both sound similar and both are related to payments, but they are not exactly the same.cash receipt and sales receipt

In this article, we’ll clearly explain:

- What is a cash receipt?

- What is a sales receipt?

- Key differences between the two

- When to use which document

- How to generate both online with GoSetle tools

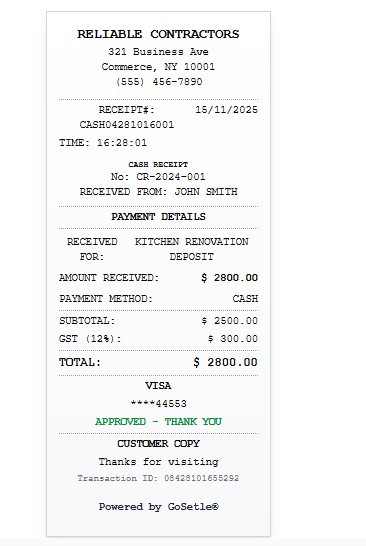

What Is a Cash Receipt?

A cash receipt is a document given when payment is received in cash.

It confirms that the business has received a specific cash amount from a customer for a product or service.

A cash receipt usually includes:

- Business name and address

- Customer name (optional)

- Date and time

- Description of payment

- Amount received in cash

- Taxes (if any)

- Signature or approval

To generate this instantly, you can use the Cash Receipt Generator.

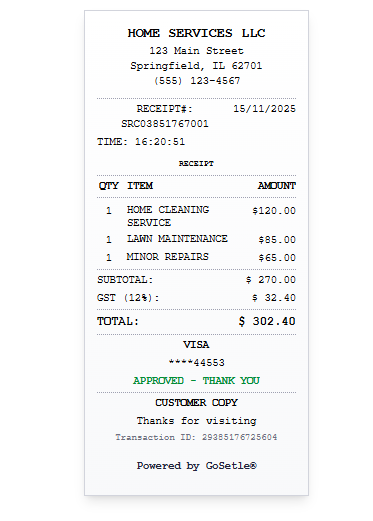

What Is a Sales Receipt?

A sales receipt confirms that a sale has happened and payment has been made. But, unlike a pure cash receipt, the payment mode can be:

- Cash

- Credit or debit card

- Bank transfer

- UPI or mobile wallet

A sales receipt usually shows:

- Business details

- Items sold or services provided

- Quantity, rate and amount

- Tax components (GST/VAT)

- Total amount

- Payment method (cash, card, UPI, etc.)

You can create a sales receipt using a Sales Receipt Generator (add your tool URL, e.g. https://gosetle.com/receipt/sales-receipt-generator).

Key Differences Between Cash Receipt and Sales Receipt

| Point | Cash Receipt | Sales Receipt |

|---|---|---|

| Purpose | Proof that cash was received | Proof that a sale was completed |

| Payment Mode | Only cash | Cash, card, bank, UPI, etc. |

| Level of Detail | Basic payment info | Detailed sale info (items, tax, etc.) |

| Usage | When recording cash inflow | When recording any completed sale |

In simple terms:

- Cash receipt = focus on how payment was received (cash).

- Sales receipt = focus on what was sold and how much was paid.

When Should You Use a Cash Receipt?

Use a cash receipt when:

- You receive cash deposits from customers

- You collect cash advances

- You record small manual cash payments (like repairs, small services)

- You want clear proof that the payment was made in cash, not online

For example:

- A tutor receiving monthly fees in cash from a student

- A small repair shop collecting cash for a service

- A landlord receiving a small cash advance

In all these cases, you can quickly generate a cash receipt using the Cash Receipt Generator.

When Should You Use a Sales Receipt?

Use a sales receipt when:

- A product or service has been sold

- Payment has been made (via any method)

- You want to show items, quantity, tax and total clearly

- You want a full breakdown of the transaction

For example:

- A retail store selling multiple items

- A restaurant billing a customer for food, drinks and taxes

- A service company billing for monthly subscription or package

This type of receipt is ideal for businesses where item-wise billing is important.

Can You Use Both Together?

Yes, in some cases, businesses use both:

- A sales receipt to show the detailed breakdown of what was sold.

- A cash receipt to separately record that the amount was received in cash.

However, for most small businesses, one document is enough, as long as it:

- Shows what was sold

- Shows how and when payment was received

Paper vs Digital Receipts for Cash and Sales

Whether it is a cash receipt or a sales receipt, you have two options:

1. Paper Receipts

- Handwritten or printed

- Easy to give directly to the customer

- But can get lost or damaged easily

2. Digital Receipts

- Created online and saved as PDF

- Can be shared by email, WhatsApp or SMS

- Easy to store and search later

- Looks more professional

With tools from the GoSetle Receipt Generator hub, you can create both cash receipts and sales receipts digitally in a few steps.

How to Create Cash and Sales Receipts Online

Here’s a simple process:

- Visit the GoSetle Receipt Generator hub.

- Choose the receipt type:

- Cash Receipt Generator

- Sales Receipt Generator

- Enter your business details.

- Add customer information and transaction details.

- Select payment method (for sales receipt).

- Click Generate and download or print the PDF.

Conclusion

Basically Both cash receipts and sales receipts are important for running a professional and compliant business.

- Use a cash receipt when you want to highlight that the payment was made in cash.

- Use a sales receipt when you want to show detailed items and totals for a sale.

Accordingly Whichever you need, you don’t have to create them manually. Just use the online tools available on the GoSetle Receipt Generator hub and generate clean, professional receipts in seconds.