Invoice Vs Quotation

Table of Contents

- Introduction

- What Is an Invoice?

- Definition

- Purpose

- Key Components

- Legal Importance

- What Is a Quotation?

- Definition

- Purpose

- Key Components

- Legal Relevance

- Core Differences Between Invoice and Quotation

- Timing

- Legal Binding

- Financial Implication

- Client Expectations

- Format & Structure

- Real-Life Use Case Comparisons

- When to Use a Quotation

- When to Use an Invoice

- Common Mistakes to Avoid

- Benefits of Using Both Correctly

- How to Create Professional Invoices and Quotations

- Industry-Specific Practices (B2B, Freelancers, E-commerce, etc.)

- Quotation vs Estimate vs Proposal vs Invoice

- Software Tools to Manage Invoices and Quotations

- International Differences in Usage

- Legal Implications and Taxation

- Tips for Small Businesses and Freelancers

- Visual Comparison Table

- Future Trends in Billing and Quoting

- Final Summary

- Frequently Asked Questions (FAQs)

1. Introduction about Invoice and Quotation

In the world of business, communication with clients is key—and one of the most essential components of this communication involves financial documentation. Two of the most commonly used financial documents are Invoices and Quotations. While both serve distinct purposes, they are often confused with each other. This guide will dissect every aspect of an invoice and a quotation, helping you understand their roles, differences, and when to use them. Whether you’re a freelancer, a small business owner, or a corporate executive, understanding the distinction between these two documents can help streamline operations and improve client relationships.

2. What Is an Invoice?

Definition

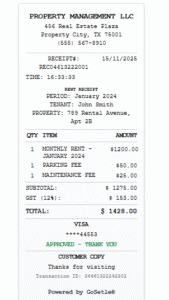

An invoice is a commercial document issued by a seller to a buyer, detailing the products or services provided, along with their respective costs. It requests payment for those goods or services.

Purpose

- Serve as a payment request.

- Record the transaction.

- Facilitate legal compliance and tax purposes.

- Help businesses track income.

Key Components

- Invoice number

- Seller and buyer information

- Date of issue

- Description of goods/services

- Quantity and unit price

- Total amount due

- Taxes (GST, VAT, etc.)

- Payment terms (due date, mode of payment)

- Additional notes (late fees, discounts)

Legal Importance

Invoices are legally binding documents. Once issued, they serve as a formal record that a transaction took place and can be used for taxation, auditing, and in case of legal disputes.

3. What Is a Quotation?

Definition

A quotation is a document that a business provides to a potential customer to offer estimated costs for requested products or services.

Purpose

- Communicate expected prices.

- Outline scope and terms of service before commitment.

- Help clients compare offers.

Key Components

- Quotation number

- Date of issue and expiration

- Description of services/products

- Estimated cost

- Delivery timeline

- Terms & conditions

- Optional services or add-ons

Legal Relevance

While not always legally binding, quotations can become binding if the client accepts and signs it. Unlike invoices, they are used pre-sale and do not demand payment.

4. Core Differences Between Invoice and Quotation

| Feature | Invoice | Quotation |

|---|---|---|

| Timing | After service/product delivery | Before service/product delivery |

| Purpose | Request payment | Provide estimated cost |

| Legal Status | Legally binding | Usually non-binding |

| Financial Implication | Represents revenue | Represents a potential deal |

| Client Action | Must pay | May negotiate or accept |

5. Real-Life Use Case Comparisons

Scenario 1: Freelance Graphic Designer

- Quotation: Sent before a project starts to quote logo design for $500.

- Invoice: Sent after the design is completed and delivered.

Scenario 2: Home Renovation Company

- Quotation: Quoting $20,000 for remodeling based on blueprints.

- Invoice: Issued once the project milestones are completed.

6. When to Use a Quotation

Use a quotation when:

- The client hasn’t yet agreed to buy.

- You want to outline terms clearly.

- Pricing depends on scope.

- Bidding for a project or responding to an RFP.

7. When to Use an Invoice

Use an invoice when:

- You’ve delivered a product/service.

- Payment is due.

- You want to keep financial records.

- Tax reporting is needed.

8. Common Mistakes to Avoid

- Using invoice instead of quotation during bidding.

- Skipping expiration dates on quotes.

- Failing to number invoices properly.

- Incorrect tax calculations.

9. Benefits of Using Both Correctly

- Improved cash flow.

- Better client communication.

- Stronger legal and audit trail.

- Professionalism and brand trust.

10. How to Create Professional Invoices and Quotations

Manual vs. Software

- Manual (Word, Excel): Flexible but error-prone.

- Software (e.g., GoSetle®, Zoho, FreshBooks): Efficient, consistent, and scalable.

Tips

- Use branded templates.

- Include all mandatory elements.

- Keep it simple and clear.

11. Industry-Specific Practices

Freelancers

- Often need detailed quotations due to varied service pricing.

- Invoices used after approval and delivery.

Retail

- Rarely uses quotations.

- Uses invoices daily for transactions.

B2B

- Heavy use of both documents with formal terms and long payment cycles.

12. Quotation vs Estimate vs Proposal vs Invoice

| Document | Purpose | Binding? |

|---|---|---|

| Quotation | Fixed pricing | Semi-binding |

| Estimate | Rough pricing | Non-binding |

| Proposal | Detailed plan | Varies |

| Invoice | Payment request | Binding |

13. Software Tools to Manage Invoices and Quotations

- GoSetle® Proforma Invoice Generator

- QuickBooks

- Zoho Invoice

- Wave

- Xero

14. International Differences in Usage

- UK & EU: Use “VAT invoices,” quotations often needed for EU tenders.

- US: Invoices often include sales tax, quotes are used for pre-approvals.

- India: GST-compliant invoices mandatory, quotations used in tenders and services.

15. Legal Implications and Taxation

- Invoices must adhere to tax laws in respective countries.

- Quotations, when signed, may lead to binding contracts.

- Keep digital copies of both for 5–7 years for audits.

16. Tips for Small Businesses and Freelancers

- Automate invoices.

- Track due dates.

- Use expiry on quotes.

- Always follow up on both.

17. Visual Comparison Table

| Feature | Invoice | Quotation |

|---|---|---|

| Purpose | Payment request | Cost offer |

| Timing | Post-service | Pre-service |

| Payment Terms | Mandatory | Optional |

| Editable After Sent? | No | Yes |

| Client Expectation | To pay | To decide |

18. Future Trends in Billing and Quoting

- AI-generated documents

- Integrated accounting suites

- Mobile invoice apps

- Dynamic pricing in quotes

- E-signature integrations

19. Final Summary

Understanding the difference between an invoice and a quotation is essential for running a smooth business operation. While a quotation helps you win a deal, an invoice ensures you get paid for it. They are two sides of the same coin, and using them correctly can boost your professionalism, trustworthiness, and financial health.

20. Frequently Asked Questions (FAQs)

Q1. Can a quotation be used as an invoice?

No, a quotation is only a price estimate and not a demand for payment. An invoice should be issued after the service/product is delivered.

Q2. Are quotations legally binding?

Not always, but they can become binding if accepted and signed by the client.

Q3. What comes first: a quote or an invoice?

A quote comes first. It provides a price estimate. An invoice follows after agreement and service delivery.

Q4. Can you negotiate after receiving a quotation?

Yes. Quotations are not final until accepted by the client.

Q5. What if a customer refuses to pay an invoice?

The invoice serves as proof of service delivery and payment agreement. Legal action can be taken if terms are not met.

Q6. Is tax applicable on quotations?

Not necessarily. Taxes are detailed and charged in invoices.

Q7. Can a quotation have an expiry date?

Yes, and it should. This ensures the pricing isn’t open indefinitely.

Q8. What is a proforma invoice?

A proforma invoice is a preliminary bill sent before the final invoice, often used in international trade.

Q9. Do freelancers need to send quotations?

Yes, especially if the client wants to know pricing before confirming the job.

Q10. What tools can I use to create quotes and invoices?

You can use GoSetle®, QuickBooks, Zoho Invoice, or Microsoft Word and Excel templates.

Q11. What is a Proforma Invoice, and how is it different from an Invoice or Quotation?

A Proforma Invoice is a preliminary bill sent to a buyer before a sale is finalized. Unlike a Quotation, which only gives an estimated price, a Proforma Invoice provides a complete overview of the goods or services, pricing, and terms—almost like a final invoice, but without demanding payment.

It differs from a regular Invoice because it’s not legally binding and doesn’t require immediate payment. Instead, it’s often used for customs declarations, budget approvals, or buyer review before committing to a purchase.

👉 Want to create one easily? Try the free GoSetle® Proforma Invoice Generator – no sign-up required!