Expense Receipts Explained: What They Are, Why Employers Ask for Them, and How to Create One Online

Across countries like the USA, UK, Canada, UAE, and Europe, expense receipts play a very important role in professional life.

Employees, freelancers, and business owners are often asked to submit receipts to get reimbursed for money they have already spent.

But many people still ask:

- What exactly is an expense receipt?

- Why do employers insist on it?

- What happens if the receipt is missing?

- How can I create a proper expense receipt quickly?

In this guide, we’ll answer these questions in a simple, practical way and explain how online receipt tools make the process easier.

What Is an Expense Receipt?

An expense receipt is proof that a person has paid money for a business-related or work-related expense.

It is commonly used for:

- Office reimbursement

- Business accounting

- Freelance client billing

- Tax and audit records

An expense receipt confirms three things clearly:

- Money was paid

- For what purpose

- On which date and for how much

Why Do Employers Ask for Expense Receipts?

This is one of the most searched questions outside India.

1. Proof of Payment

Companies need confirmation that the employee actually paid the expense.

2. Accounting & Audits

Businesses must keep records to justify expenses during audits.

3. Policy Compliance

Most companies reimburse only approved expenses supported by receipts.

4. Tax Documentation

Expense receipts help businesses calculate taxable income correctly.

Without a receipt, many companies simply reject the reimbursement request.

Common Types of Expense Receipts

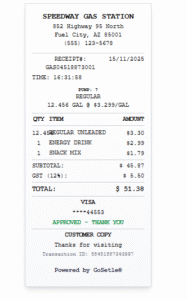

Outside India, people mostly submit expense receipts for:

- Taxi or cab travel

- Hotel stays

- Meals and fast food

- Fuel and gas station payments

- Parking and toll charges

- Small business purchases

Each of these needs a clear, readable receipt with correct details.

That’s why many users prefer using online receipt generators instead of handwritten slips.

What Should an Expense Receipt Include?

No matter the country, a proper expense receipt should include:

- Business or service provider name

- Date of payment

- Description of expense

- Amount paid

- Tax (if applicable, such as VAT or sales tax)

- Payment method

Receipts missing these details are often rejected.

Using a professional receipt generator ensures these fields are always included.

How to Create an Expense Receipt Online

Instead of searching for templates or writing receipts manually, most users now create expense receipts online.

Using the GoSetle Receipt Generator, the process is simple:

- Choose the receipt type related to your expense

- Enter basic payment details

- Add amount and tax (if applicable)

- Generate a clean, printable PDF receipt

This works well for both personal and business expenses.

Why Online Expense Receipts Are Preferred Globally

People working in international companies prefer digital receipts because they are:

- Easy to upload in expense systems

- Accepted by HR and finance teams

- Printable when needed

- Simple to store and resend

This is especially useful for remote workers and freelancers who work with clients across different countries.

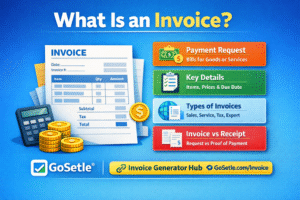

Expense Receipt vs Invoice (Quick Clarification)

Another common confusion is between invoices and expense receipts.

- Invoice: Request for payment

- Expense Receipt: Proof that payment has already been made

For reimbursement, employers almost always ask for receipts, not invoices.

When Should You Create an Expense Receipt?

You should always create or keep an expense receipt when:

- You spend money on behalf of your company

- You plan to claim reimbursement

- You need proof for accounting or tax purposes

- You are working as a freelancer or consultant

Creating a receipt immediately avoids problems later.

Conclusion

Expense receipts are not just paperwork — they are essential proof for reimbursement, accounting, and professional transparency.

Instead of relying on handwritten slips or unclear bills, creating clean digital expense receipts using online tools saves time and prevents rejection.

If you want a simple and professional way to create expense receipts, using an online receipt generator is the smartest option.