A proforma invoice is a preliminary commercial document issued by a seller to a buyer before the actual sale or delivery of goods and services. It provides an estimated overview of pricing, product details, and transaction terms, helping both parties reach mutual agreement before a final invoice is issued.

Unlike a sales invoice, a proforma invoice does not create a legal obligation to pay. Instead, it acts as a transparent communication tool widely used in domestic business transactions as well as international trade.

GoSetle® Proforma Invoice Generator enables businesses to create professional, accurate proforma invoices online in just a few clicks, eliminating the need for manual templates or complex documentation.

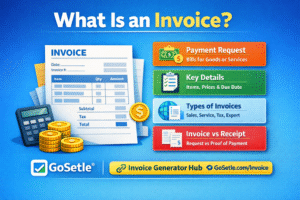

What Is a Proforma Invoice?

A proforma invoice is a non-binding document that outlines the expected cost and terms of a proposed sale. Sellers use it to inform buyers about pricing, quantities, delivery timelines, and payment conditions before the transaction is finalized.

This document is especially useful when buyers need to review costs internally, obtain approvals, or arrange advance payments. While it looks similar to a standard invoice, it is clearly marked as “proforma” to indicate that it is not a demand for payment.

To understand the definition in detail, you can also read:

What is a Proforma Invoice? Meaning, Key Features & Why Your Business Needs One

Why Businesses Use a Proforma Invoice

Businesses across industries rely on proforma invoices to ensure clarity and avoid misunderstandings before issuing a final invoice. Common reasons for using a proforma invoice include:

Confirming prices and quantities before production or delivery

Providing buyers with a clear cost estimate

Supporting import and export documentation

Helping buyers arrange advance or partial payments

Reducing disputes related to pricing or terms

Once the buyer agrees to the terms mentioned in the proforma invoice, the seller can proceed with fulfillment and issue a final sales invoice for accounting and taxation purposes.

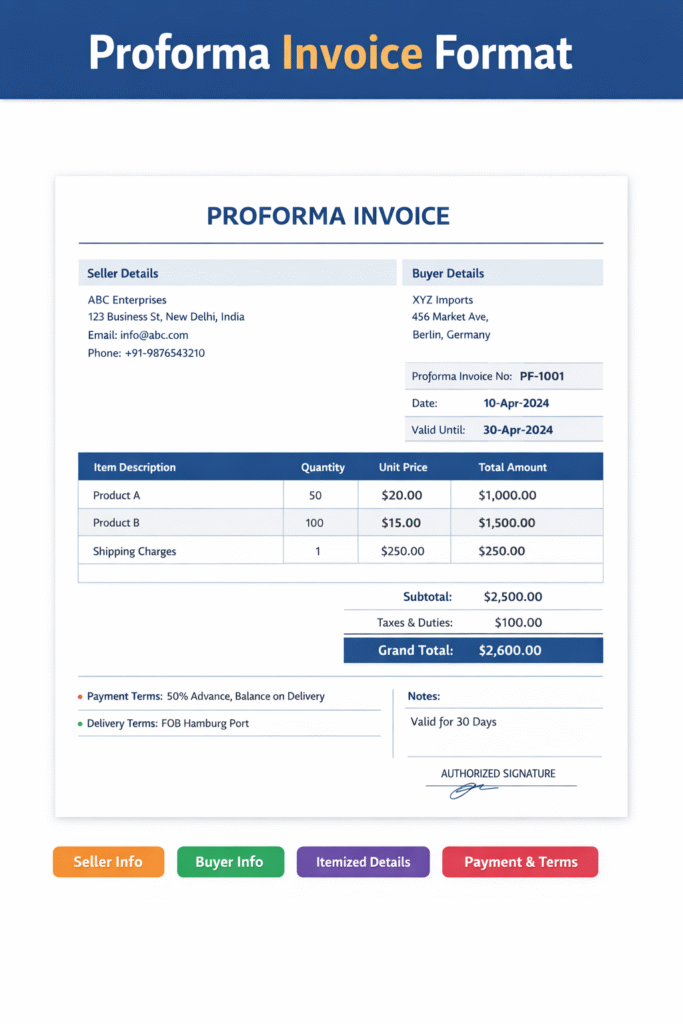

Proforma Invoice Format

Although there is no legally fixed format, a standard proforma invoice generally contains the following information:

Seller’s business details including name and address

Buyer’s name and billing details

Proforma invoice number and issue date

Detailed description of goods or services

Quantity, unit price, and total estimated value

Applicable taxes, duties, or charges

Payment terms and delivery conditions

Validity period of the offer

Using an online generator ensures that all essential fields are included in a professional and globally accepted format.

| Section | Description |

|---|---|

| Seller Details | Business name, address, contact |

| Buyer Details | Customer name and address |

| Proforma Invoice Number | Reference number |

| Issue Date | Date of issuance |

| Item Description | Products or services |

| Quantity & Unit Price | Cost breakdown |

| Total Amount | Estimated total value |

| Taxes & Duties | If applicable |

| Payment Terms | Advance / credit terms |

| Validity | Offer validity period |

Proforma Invoice Example

Consider an example of an international transaction:

An exporter sends a proforma invoice to an overseas buyer listing product specifications, pricing, delivery terms, and estimated duties. The buyer reviews the document, confirms the order, and uses the proforma invoice to arrange bank approvals or customs documentation.

After confirmation and shipment, the exporter issues a commercial or sales invoice for final payment and accounting.

When Is a Proforma Invoice Required?

A proforma invoice is commonly required in situations such as:

When a buyer requests a formal price quotation

Before shipping goods internationally

When customs authorities require estimated invoice value

For obtaining import licenses or foreign exchange approvals

When advance payment is requested prior to production

For a detailed international trade perspective, read:

When Is a Proforma Invoice Required in International Trade? A Complete Guide

Proforma Invoice vs Sales Invoice

The primary difference between a proforma invoice and a sales invoice lies in their purpose and legal standing. A proforma invoice is issued before the sale and serves as an estimate, while a sales invoice is issued after delivery and creates a legal obligation for payment.

Businesses typically use a proforma invoice for approval and negotiation, followed by a final invoice for billing, taxation, and record-keeping.

Is a Proforma Invoice Legally Binding?

No, a proforma invoice is not legally binding. It does not require the buyer to make payment and cannot be used as an accounting document. Legal responsibility arises only after a final invoice is issued or a contract is signed.

Create a Proforma Invoice Online Using GoSetle

Creating proforma invoices manually using spreadsheets or word processors can be time-consuming and error-prone. GoSetle® Proforma Invoice Generator simplifies the process by allowing businesses to generate accurate, professional invoices instantly.

Key benefits include:

Instant PDF download

Internationally accepted format

No watermark on invoices

No registration required

You can create your proforma invoice here:

Proforma Invoice

Explore More Invoice Tools

GoSetle® also offers a complete suite of invoicing tools to support business operations, including sales invoices, purchase orders, and delivery documents.

Explore all tools here:

Invoice Generator

Frequently Asked Questions (FAQs)

Can I receive payment on a proforma invoice?

Yes, advance payment can be requested, but it is not legally mandatory.

Is a proforma invoice valid for customs?

Yes, it is commonly used for customs valuation before shipment.

Can a proforma invoice be canceled?

Yes, since it is non-binding, it can be modified or canceled.

Is GST applicable on a proforma invoice?

No. GST is applicable only on the final tax invoice.