When Is a Proforma Invoice Required in International Trade? A Complete Guide

In international trade, documentation plays a critical role.

One of the most commonly requested documents before shipping goods is a proforma invoice .

Exporters, importers, customs authorities, and banks often ask:

- When is a proforma invoice required?

- Why not use a regular invoice?

- Is a proforma invoice mandatory for exports?

In this guide, we’ll clearly explain when a proforma invoice is required in international trade, why it is used, and how businesses create it professionally using online tools.

What Is a Proforma Invoice in International Trade?

In global trade, a proforma invoice is a preliminary document sent by an exporter to an importer before shipment or payment.

It provides advance information about:

- Goods or services being sold

- Price and quantity

- Delivery and shipping terms

- Estimated taxes or duties

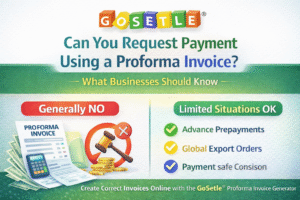

Unlike a commercial invoice, a proforma invoice does not request payment and is not used for accounting entries.

Because of this, it is widely accepted as a planning and approval document in cross-border transactions.

When Is a Proforma Invoice Required?

A proforma invoice is required or requested in several international trade situations.

1️⃣ Before Exporting Goods

Before goods are shipped internationally, buyers often ask for a proforma invoice to:

- Review pricing and quantities

- Confirm product specifications

- Approve the purchase internally

This helps avoid disputes after shipment.

2️⃣ For Import Customs & Compliance

In many countries, customs authorities may request a proforma invoice:

- To assess the value of goods

- To estimate duties and taxes

- When a commercial invoice is not yet available

The proforma invoice helps customs understand the nature of the shipment in advance.

3️⃣ For Letter of Credit (LC) Processing

Banks commonly require a proforma invoice before issuing a letter of credit.

The document helps banks verify:

- Transaction value

- Seller and buyer details

- Payment terms

Without a proforma invoice, LC approval is often delayed.

4️⃣ For Import Licenses or Permits

In some regions, importers must submit a proforma invoice to government authorities to:

- Apply for import licenses

- Request special permits

- Get foreign exchange approvals

The proforma invoice acts as a supporting document for these applications.

5️⃣ For Price Quotation & Negotiation

In international trade, prices often change due to:

- Shipping costs

- Exchange rates

- Customs duties

A proforma invoice allows both parties to:

- Negotiate terms

- Lock pricing temporarily

- Set expectations before final invoicing

Proforma Invoice vs Commercial Invoice in Trade

Understanding the difference is crucial.

| Feature | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Issued | Before shipment | After shipment |

| Purpose | Estimate / confirmation | Legal billing |

| Payment required | No | Yes |

| Used for accounting | No | Yes |

| Customs use | Preliminary | Final clearance |

In short:

- Proforma invoice → planning stage

- Commercial invoice → final transaction stage

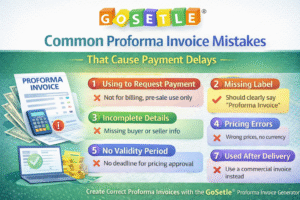

What Information Should a Trade Proforma Invoice Include?

A proforma invoice for international trade should clearly mention:

- Exporter and importer details

- Proforma invoice number and date

- Description of goods

- HS codes (if available)

- Quantity and unit price

- Total value

- Currency

- Delivery terms (Incoterms)

- Estimated shipping costs

- Payment terms (reference only)

- Validity period

Using a professional GoSetle® Proforma Invoice Generator ensures all required fields are included correctly.

How to Create a Proforma Invoice for International Trade

Most exporters now create proforma invoices online instead of manual documents.

Using the GoSetle® Proforma Invoice Online , businesses can:

- Enter exporter and importer details

- Add product or service descriptions

- Set quantities, prices, and currency

- Include delivery and payment terms

- Generate a professional PDF proforma invoice

This helps ensure accuracy and global compliance.

When Is a Proforma Invoice NOT Required?

A proforma invoice is usually not required when:

- Goods are already shipped

- Payment is immediately due

- A final commercial invoice is available

In these cases, a commercial invoice should be used instead.

Who Uses Proforma Invoices in International Trade?

Proforma invoices are commonly used by:

- Exporters and manufacturers

- Importers and distributors

- International wholesalers

- B2B service providers

- Trading companies

They help align expectations before goods or money move across borders.

Conclusion

A proforma invoice is required in international trade whenever pricing, shipment, or approval must be confirmed before the actual transaction takes place.

It plays a key role in:

- Export preparation

- Import approvals

- Banking and customs processes

To avoid delays and errors, businesses prefer generating proforma invoices using professional online tools like the GoSetle® Proforma Invoice Generator, ensuring accuracy and global acceptance.

Try : GoSetle® Invoice

Read : How to Create a Proforma Invoice Online with GoSetle® (Free, Easy & Professional)